Feeling overwhelmed by your finances? Juggling multiple bank accounts, credit cards, and bills can be a daunting task. In today’s digital age, financial software has emerged as a powerful tool for simplifying your money management. From budgeting and tracking expenses to investing and planning for retirement, the right software can empower you to take control of your financial future.

But with so many options available, how do you choose the best personal finance software for your needs? This comprehensive guide will explore the top contenders in the market, breaking down their features, pros, and cons to help you make an informed decision. Whether you’re a seasoned investor or just starting your financial journey, this article will equip you with the knowledge to find the perfect software to master your money in 2023.

Mint

Mint is a popular and free personal finance management tool offered by Intuit. It’s known for its user-friendly interface, comprehensive features, and ability to connect to various financial institutions. With Mint, you can easily track your spending, create budgets, monitor your credit score, and set financial goals.

Key Features of Mint:

- Budgeting: Create detailed budgets, track spending by category, and get alerts when you’re close to exceeding your limits.

- Account Aggregation: Connect all your bank accounts, credit cards, loans, and investments to view a consolidated overview of your finances.

- Spending Analysis: Analyze your spending habits and identify areas where you can save money.

- Bill Payment: Schedule and pay bills directly through the platform.

- Credit Score Monitoring: Monitor your credit score and get alerts for any changes.

- Financial Goal Setting: Set savings goals, track your progress, and receive personalized recommendations.

Pros of Using Mint:

- Free to use.

- Easy-to-use interface.

- Comprehensive features for managing finances.

- Strong security measures.

- Mobile app availability for on-the-go access.

Cons of Using Mint:

- Limited customization options for some features.

- Occasional data syncing issues.

- Not ideal for advanced financial planning or investment management.

Overall, Mint is a great option for individuals looking for a free and user-friendly tool to manage their personal finances. It provides a comprehensive overview of your financial situation and helps you track your spending, create budgets, and achieve your financial goals. However, it’s important to consider its limitations if you require advanced financial planning or investment management capabilities.

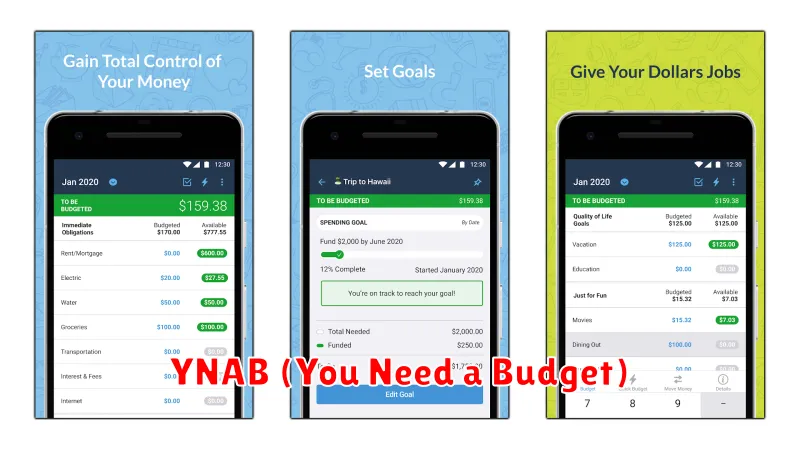

YNAB (You Need a Budget)

YNAB stands for “You Need a Budget” and is a popular budgeting software that emphasizes a “zero-based budgeting” approach. It’s designed to help users take control of their finances by tracking every dollar they earn and ensuring every dollar has a specific purpose.

Key Features:

- Zero-Based Budgeting: YNAB promotes assigning every dollar a job, preventing overspending and encouraging saving.

- Budgeting for the Future: YNAB allows you to budget for upcoming bills and expenses, helping you prepare for future financial obligations.

- Goal Setting: YNAB allows you to set financial goals and track your progress towards achieving them.

- Financial Reports: YNAB provides detailed financial reports that can help you analyze your spending habits and identify areas where you can save money.

- Mobile App: YNAB offers a user-friendly mobile app that allows you to manage your budget on the go.

Pros:

- Effective Budgeting System: YNAB’s zero-based budgeting approach can help you gain control of your finances and reach your financial goals.

- User-Friendly Interface: YNAB is designed for ease of use, making it accessible to a wide range of users.

- Strong Community Support: YNAB has a large and active community of users who can provide support and guidance.

Cons:

- Subscription Fee: YNAB requires a monthly subscription fee.

- Steep Learning Curve: Some users may find YNAB’s budgeting method and interface to be challenging to learn initially.

Overall, YNAB is a comprehensive budgeting software that can be a valuable tool for anyone looking to take control of their finances. While it does have a subscription fee and a steep learning curve, its effectiveness in helping users achieve their financial goals makes it a popular choice among many users.

Personal Capital

If you’re looking for a powerful and user-friendly platform to help you take control of your finances, Personal Capital is an excellent option. It’s a free financial management tool that offers a range of features to help you track your spending, budget, and investments. Here’s why it stands out:

Comprehensive Financial Dashboard: Personal Capital provides a clear and concise overview of your entire financial picture, including bank accounts, credit cards, retirement accounts, and investments. This helps you see where your money is going and identify areas where you can save.

Advanced Investment Analysis: The platform goes beyond just tracking your investments. It uses sophisticated algorithms to analyze your portfolio’s performance, identify potential risks, and recommend adjustments to improve returns. You can even receive personalized investment advice from certified financial advisors.

Goal-Based Budgeting: Personal Capital helps you set financial goals and track your progress toward achieving them. Its budgeting tools make it easy to allocate your funds effectively and stay on track with your savings targets.

Free and User-Friendly: Personal Capital offers its core features for free, making it accessible to a wide range of users. The platform is also very user-friendly, with a clean and intuitive interface.

While Personal Capital is a fantastic option for managing your finances, it’s essential to consider its limitations. The platform doesn’t offer traditional banking services, such as checking or savings accounts. If you’re looking for a platform that combines financial management with banking services, you might need to explore other options.

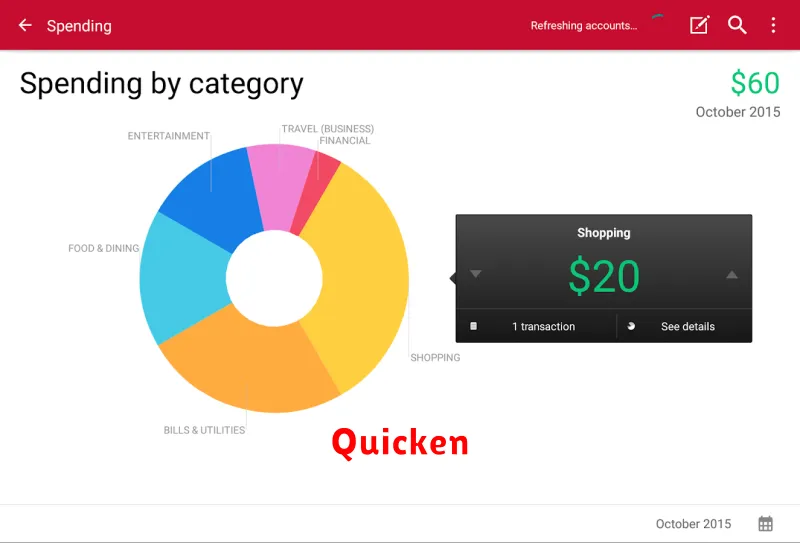

Quicken

Quicken is a popular personal finance software that helps you manage your money, track your spending, budget, and invest. It is available as a desktop application and a mobile app, so you can access your finances from anywhere.

Key features of Quicken:

- Budgeting: Create and track budgets for different categories, like groceries, entertainment, and bills.

- Spending tracking: Easily track your spending with automatic transaction downloads from your bank accounts.

- Bill payment: Schedule and pay bills directly from the software.

- Investment tracking: Monitor your investments, including stocks, bonds, and mutual funds.

- Debt management: Track and manage your debt, including credit cards and loans.

- Financial planning: Create financial goals and plans, such as retirement or saving for a house.

Pros:

- Comprehensive feature set

- Easy to use interface

- Strong budgeting and spending tracking capabilities

- Excellent customer support

Cons:

- Can be expensive, especially for advanced features

- Desktop version can be slow at times

- Mobile app is not as feature-rich as the desktop version

Overall, Quicken is a powerful and versatile personal finance software that can help you take control of your money. If you are looking for a comprehensive solution with strong budgeting and spending tracking capabilities, Quicken is a great option. However, consider the cost and limitations of the software before making a decision.

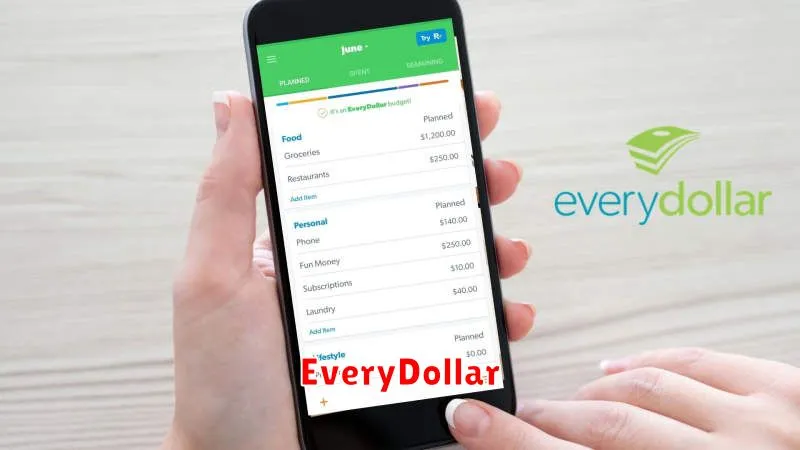

EveryDollar

EveryDollar is a zero-based budgeting app designed by Dave Ramsey. It operates on the premise of allocating every dollar you earn to a specific purpose, hence the name. EveryDollar is known for its simplicity and its adherence to Ramsey’s principles of debt elimination and financial independence.

Here’s what sets EveryDollar apart:

- Zero-Based Budgeting: EveryDollar encourages you to assign every dollar you earn to a specific category, leaving no room for unnecessary spending.

- Debt Snowball Method: Aligning with Ramsey’s philosophy, the app helps you prioritize paying off debt using the snowball method, focusing on the smallest debt first.

- Budgeting Tools: EveryDollar provides user-friendly tools for tracking income, expenses, and setting spending limits.

- Cash Envelope System: EveryDollar is designed to work well with the cash envelope system, where you physically allocate cash to different categories.

- No-Frills Approach: EveryDollar emphasizes simplicity and avoids fancy features, making it accessible for beginners.

EveryDollar is a great option if you:

- Are looking for a free budgeting tool with a strong focus on debt management.

- Prefer a simple and straightforward approach to budgeting.

- Are a fan of Dave Ramsey’s financial philosophies.

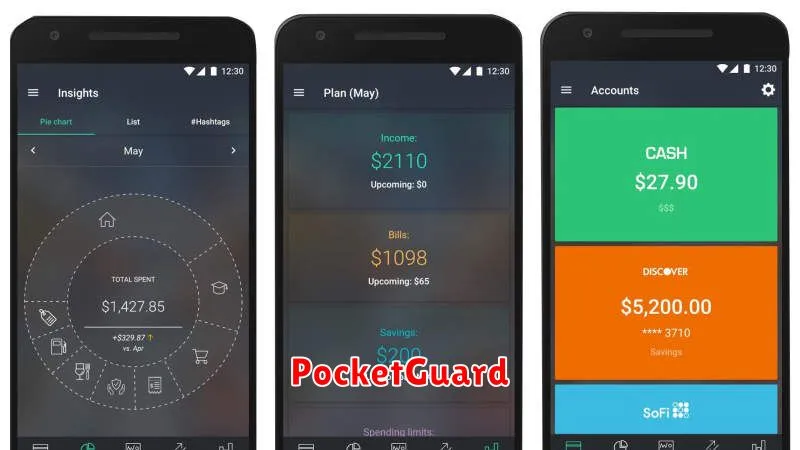

PocketGuard

PocketGuard is a user-friendly budgeting app that simplifies financial management. Its intuitive interface and clever features help you track your spending, set budgets, and reach your financial goals.

A key feature of PocketGuard is its “In My Pocket” functionality. This feature estimates your available spending money by considering your income, bills, and recurring expenses. It also offers insights into where your money is going, allowing you to make informed decisions about your spending.

Another standout feature is the “Goal Setting” tool. You can set financial goals, such as saving for a vacation or paying off debt, and PocketGuard will help you stay on track. It even suggests ways to cut spending to achieve your goals faster.

PocketGuard also provides a comprehensive “Bills” section where you can manage all your bills, including setting reminders and tracking due dates. This helps you avoid late fees and stay on top of your financial obligations.

PocketGuard is a valuable tool for anyone looking to gain control of their finances. Its easy-to-use interface, insightful features, and goal-oriented approach make it a powerful ally in your journey to financial freedom.

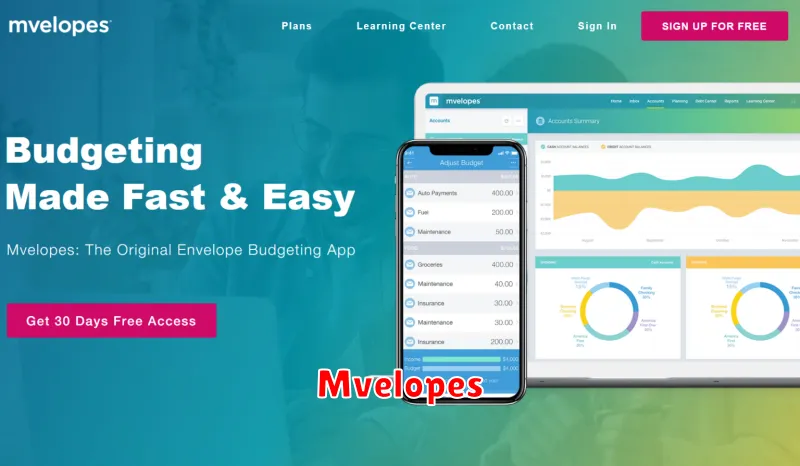

Mvelopes

Mvelopes is a budgeting method that utilizes envelopes to separate your money into specific categories. This method is effective because it makes it easy to track your spending, stay within your budget, and avoid overspending. It’s a great method for those who prefer a hands-on approach to their finances.

While traditionally you would use physical envelopes, the modern world has brought about digital options such as Mvelopes, a budgeting app that mimics the old-fashioned system.

Mvelopes allows you to:

- Create digital envelopes for different spending categories.

- Track your spending in real-time and see how much money is left in each envelope.

- Set spending limits for each envelope.

- Receive alerts when you are close to reaching your spending limit.

- Easily reconcile your bank account with your budget.

Mvelopes is a great option for people who want a simple, visual budgeting method that helps them stay on track with their spending.

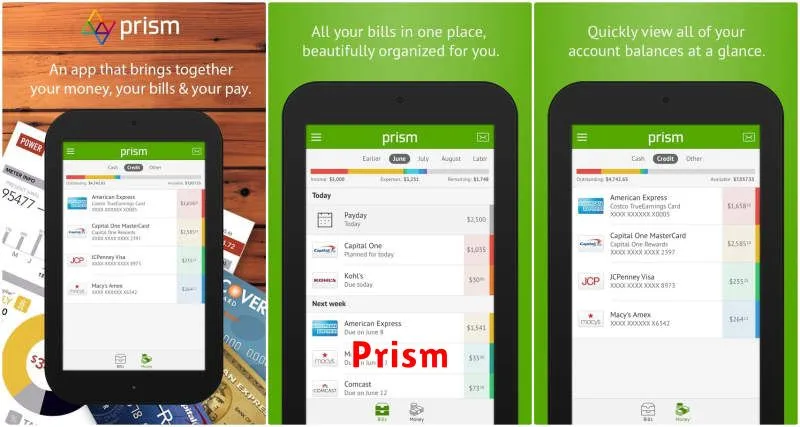

Prism

Prism is a personal finance app that stands out for its sleek design and its focus on helping you understand your spending patterns. It goes beyond simply tracking your transactions. Prism analyzes your spending habits, providing personalized insights and recommendations to help you achieve your financial goals.

One of the key features of Prism is its ability to automatically categorize your transactions. This eliminates the tedious task of manually tagging each expense, giving you a clearer picture of where your money is going.

Prism also excels in predictive budgeting. By analyzing your spending history, it can estimate your future expenses and suggest adjustments to your budget to avoid overspending. It can even help you identify potential savings by highlighting areas where you might be spending more than necessary.

While Prism offers many valuable features, it’s important to note that it primarily focuses on tracking and analyzing your spending. It doesn’t offer investment management or other advanced financial tools.

If you’re looking for a visually appealing app that can help you gain insights into your spending habits and make informed financial decisions, Prism is worth considering.

Zeta

Zeta is a financial management software that offers a comprehensive suite of tools to help users track their spending, budget, and investments. It boasts a user-friendly interface and robust features, making it an excellent choice for individuals and families looking to gain control of their finances.

Here are some of the key features that make Zeta stand out:

- Automated budgeting: Zeta can automatically categorize your transactions and create personalized budgets based on your spending patterns.

- Goal tracking: Set financial goals like saving for a down payment or retirement and track your progress towards them.

- Investment management: Zeta allows you to track your investments, monitor performance, and analyze your portfolio.

- Bill payment reminders: Avoid late fees by setting reminders for upcoming bills and paying them on time.

- Financial reports: Get detailed insights into your spending habits, net worth, and investment performance.

- Secure data encryption: Rest assured that your financial data is protected with advanced security measures.

Overall, Zeta is a comprehensive and user-friendly financial management software that empowers users to take control of their finances. Its intuitive interface, automated budgeting features, and robust analytics tools make it a valuable asset for anyone seeking to manage their money effectively.

Honeydue

Honeydue is a unique financial app that focuses on couples. It’s built to help partners manage their finances together, seamlessly. Honeydue allows you to:

- Connect bank accounts: Link your individual accounts to gain a complete view of your joint finances.

- Set budgets: Work together to create and track budgets for different categories.

- Track spending: See exactly where your money is going, and easily identify areas for saving.

- Communicate: Easily chat with your partner about finances within the app.

- Pay bills: Schedule and pay bills together, ensuring you stay on top of due dates.

- Set financial goals: Collaborate on saving for important life milestones.

Honeydue goes beyond traditional budgeting tools by incorporating features like:

- Financial coaching: Access expert advice on financial planning and managing money.

- Debt management: Track and pay down debt together.

- Investment tracking: Monitor investments and progress toward financial goals.

Overall, Honeydue is an excellent option for couples seeking a user-friendly and collaborative way to manage their finances and strengthen their financial relationship.